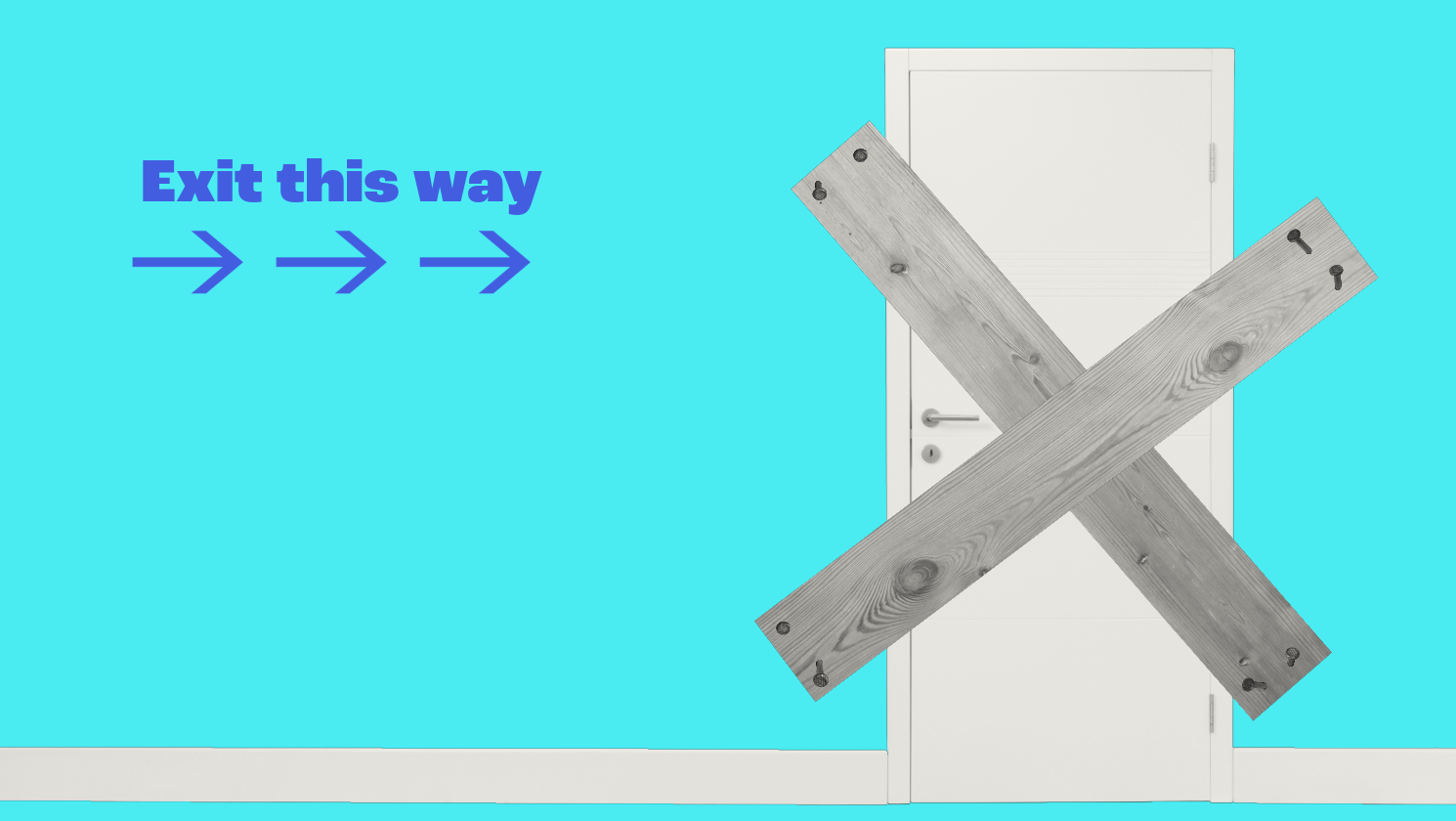

3 ways firm owners sabotage their business exit

The deal is done.

Contract signed.

Champagne popped.

But the integration phase, post-completion, is where deals can quietly go wrong.

Not because of the buyer.

But because the seller hasn’t got their head round the situation.

Here are the 3 ways we’ve seen founders sabotage their exit after the deal is done.

1️⃣They undermine the new owner, publicly or privately

The buyer steps in. New systems. New structures. New ways of doing things.

And the seller?

They say things like:

- “This isn’t how we used to do it.”

- “I wouldn’t have changed that.”

- “I don’t agree, but we’ll have to go along with it”

To the team. To clients. Sometimes even to the buyer.

Whether intentional or not, it erodes confidence, fast.

The buyer looks weak. The team gets confused. Clients sense the tension and start to walk.

And when clients leave, the seller’s payout goes down.

Lesson: You don’t have to agree with everything. But you do have to back the buyer. If you’re staying on post-sale, you’re the bridge between old and new. Not the buyers biggest critic.

2️⃣ They forget they’ve sold their business

The deal’s done and the first tranche of cash has hit the bank.

And yet, the seller is still acting like they’re fully in charge.

- Making business decisions without informing the buyer

- Keep introducing their firm as “my business”

- Giving discounts or deals to clients

It’s not malicious. It’s muscle memory.

But it sends the wrong message. To the buyer, the team and the clients.

Lesson: Remember you’ve sold your business, you’re no longer the boss. You don’t have to disappear. But you do have to play the game.

3️⃣ They don’t fulfil their side of the deal

A lot of sellers don’t pay attention to what the contract requires them to do after completion.

We’ve seen sellers:

- Take last minute holidays without telling the buyer

- Miss client handover meeting deadlines

- Refuse to come into the office

Sometimes it’s burnout. Sometimes it’s ego. Sometimes it’s just poor planning.

But the damage is real.

Integration delayed, annoyed buyer and clients feeling unloved.

Lesson: A deal isn’t done when the ink dries. It’s done when your handover is complete. Honour your commitments.

The bottom line?

You’ve sold the business. Your bank balance proves it.

Now it’s about how you show up. For the buyer, your team and your clients.

It’s important to look past the deal and prepare for the part after the contract is signed.

Thinking about selling? Let’s talk.

Meet the Author